I have a propensity for taking a gander at how modest or costly stocks in Singapore are toward the begin of every month and I do this for a justifiable reason: Knowing where we are can give us critical and valuable contributing point of view. Howard Denote, an amazingly savvy financial specialist, once said: "We may never know where we're going, however we would do well to have a smart thought where we are."

One perspective on quality :

In this activity, I utilize two diverse approaches to take a gander at the estimation of stocks in Singapore. The first is more straightforward and includes a correlation of the business sector's present valuation with the long haul normal.

In our nearby setting, the "business sector" can be spoken to by the Straits Times Record (SGX: ^STI). Information on the basics of the SPDR STI ETF (SGX: ES3) can likewise be a decent intermediary for those of the file. That is on the grounds that the SPDR STI ETF is a trade exchanged asset that emulates the Straits Times Record.

The accompanying are the valuation numbers I'm keen on:

Long haul normal: The Straits Times File has had a normal cost to-profit (PE) proportion of 16.9 for the 37 years from 1973 to 2010.

Current valuation: The SPDR STI ETF has a PE proportion of 12 starting 31 July 2016.

Occurrences when amazing valuations showed up: 1973 is a decent case of a year with high valuations as the Straits Times List's PE came to 35. The begin of 2009 is an instance of the business sector being truly shabby as the chronicled PE tumbled to only 6.

Given the numbers we've seen, I believe it's sensible to infer that stocks in Singapore are less expensive than normal right now. So, it's reasonable too that we're not near insane modest domain.

Another perspective on worth :

The following strategy I use to gage the estimation of stocks in Singapore is to check the quantity of net-net stocks there are in the business sector.

A net-net stock is a stock with a business sector capitalisation that is lower than its net current resource esteem. Numerically, the net current resource worth is given by this condition:

Net current resource esteem = Aggregate current resources less aggregate liabilities

In principle, a net-net stock is an extraordinary deal. That is on account of financial specialists can get a markdown on the organization's present (resources, for example, money and stock) net of all liabilities. Additionally, the organization's settled long haul (resources, for example, properties, industrial facilities, seemingly perpetual hardware and so on.) are tossed in with the general mish-mash for nothing.

In this way, the rationale takes after that if there are an extensive number of net-net stocks around in Singapore, then the business sector is prone to be truly modest.

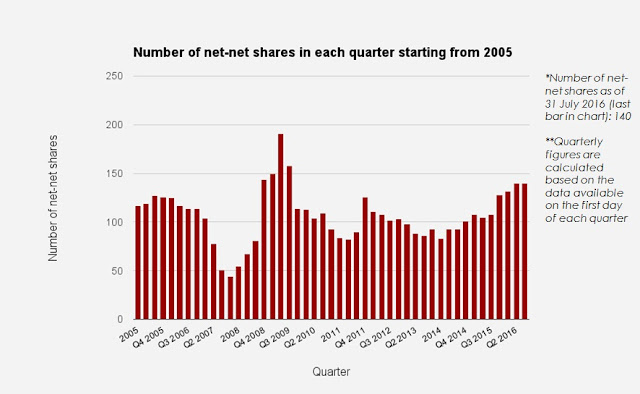

Here's a graph demonstrating how the net-net stock check in Singapore has changed subsequent to the begin of 2005:

Number of net-net shares in every quarter beginning from 2005 (July 2016)

Source: S&P Worldwide Business sector Knowledge

There are two things I need to call attention to with the graph. To start with, the quantity of net-net stocks achieved a low of under 50 in the second-50% of 2007; that is additionally the time when the Straits Times Record topped amid the Incomparable Money related Emergency. Second, the quantity of net-net stocks almost hit 200 in the second-50% of 2009; that was the time when the Straits Times List achieved a base amid the emergency.

Starting 31 July 2016, there are 140 net-net stocks. This number of 140 sits between the two extremes found in the previous decade and is likewise close to the most elevated it has been following the second-50% of 2009. These lead me to imagine that stocks in Singapore are nearer to the modest end at little to no cost to-costly range.

A Numb-skull's take :

I've shared two unique techniques to esteem the share trading system in Singapore and both give comparative takeaways: Stocks in Singapore are modest, however not low priced.

As a long haul financial specialist, this sounds like what my ears were waiting to hear. Presently, I had stressed the expression "long haul" for a justifiable reason. Valuations let us know almost no about what stocks will do over the short-term. It's just over long time skylines that valuations begin getting to be vital.

One perspective on quality :

In this activity, I utilize two diverse approaches to take a gander at the estimation of stocks in Singapore. The first is more straightforward and includes a correlation of the business sector's present valuation with the long haul normal.

In our nearby setting, the "business sector" can be spoken to by the Straits Times Record (SGX: ^STI). Information on the basics of the SPDR STI ETF (SGX: ES3) can likewise be a decent intermediary for those of the file. That is on the grounds that the SPDR STI ETF is a trade exchanged asset that emulates the Straits Times Record.

The accompanying are the valuation numbers I'm keen on:

Long haul normal: The Straits Times File has had a normal cost to-profit (PE) proportion of 16.9 for the 37 years from 1973 to 2010.

Current valuation: The SPDR STI ETF has a PE proportion of 12 starting 31 July 2016.

Occurrences when amazing valuations showed up: 1973 is a decent case of a year with high valuations as the Straits Times List's PE came to 35. The begin of 2009 is an instance of the business sector being truly shabby as the chronicled PE tumbled to only 6.

Given the numbers we've seen, I believe it's sensible to infer that stocks in Singapore are less expensive than normal right now. So, it's reasonable too that we're not near insane modest domain.

Another perspective on worth :

The following strategy I use to gage the estimation of stocks in Singapore is to check the quantity of net-net stocks there are in the business sector.

A net-net stock is a stock with a business sector capitalisation that is lower than its net current resource esteem. Numerically, the net current resource worth is given by this condition:

Net current resource esteem = Aggregate current resources less aggregate liabilities

In principle, a net-net stock is an extraordinary deal. That is on account of financial specialists can get a markdown on the organization's present (resources, for example, money and stock) net of all liabilities. Additionally, the organization's settled long haul (resources, for example, properties, industrial facilities, seemingly perpetual hardware and so on.) are tossed in with the general mish-mash for nothing.

In this way, the rationale takes after that if there are an extensive number of net-net stocks around in Singapore, then the business sector is prone to be truly modest.

Here's a graph demonstrating how the net-net stock check in Singapore has changed subsequent to the begin of 2005:

Number of net-net shares in every quarter beginning from 2005 (July 2016)

Source: S&P Worldwide Business sector Knowledge

There are two things I need to call attention to with the graph. To start with, the quantity of net-net stocks achieved a low of under 50 in the second-50% of 2007; that is additionally the time when the Straits Times Record topped amid the Incomparable Money related Emergency. Second, the quantity of net-net stocks almost hit 200 in the second-50% of 2009; that was the time when the Straits Times List achieved a base amid the emergency.

Starting 31 July 2016, there are 140 net-net stocks. This number of 140 sits between the two extremes found in the previous decade and is likewise close to the most elevated it has been following the second-50% of 2009. These lead me to imagine that stocks in Singapore are nearer to the modest end at little to no cost to-costly range.

A Numb-skull's take :

I've shared two unique techniques to esteem the share trading system in Singapore and both give comparative takeaways: Stocks in Singapore are modest, however not low priced.

As a long haul financial specialist, this sounds like what my ears were waiting to hear. Presently, I had stressed the expression "long haul" for a justifiable reason. Valuations let us know almost no about what stocks will do over the short-term. It's just over long time skylines that valuations begin getting to be vital.

Visit www.mmfsolutions.sg or www.mmfsolutions.my and register yourself for trading. Get 3 days free trials and make profit in trading.

No comments:

Post a Comment