The SGX Land File is a file made up of 50 Singapore-recorded land organizations. It additionally houses a portion of the biggest land organizations in the nearby securities exchange.

A late report had given some understanding on the different scope of land organizations that the record offers. This is what I had learnt about the record's five biggest stocks from the report and in addition from different sources (information starting 26 August 2016, unless generally expressed):

Sitting at the highest point of the load is Hongkong Land Possessions Restricted (SGX: H78). Consistent with its name, most of the organization's properties are situated in Hong Kong. Hongkong Land Property has a business sector capitalisation of S$14.9 billion. Its shares have delivered all out returns of 36.4% in the course of the most recent five years.

CapitaLand Constrained (SGX: C31) is next, saying something with a S$13.3 billion business sector top. The association's center markets are Singapore and China. CapitaLand's shares have performed possibly superior to anything Hongkong Land, checking in an aggregate return of around 41% over the same time frame.

In third place is Worldwide Logistic Properties Ltd (SGX: MC0). The organization portrays itself as a main supplier of current logistics offices in China, Japan, Brazil, and the Assembled States. Worldwide Logistic Properties has a business sector top of S$8.9 billion and has produced absolute returns of around 27% throughout the most recent five years.

City Advancements Constrained (SGX: C70) secures the fourth spot. The land working organization tips the scales at somewhat over S$8 billion and has a worldwide nearness in 26 nations. It additionally has lodging resources that originate from its stake in Thousand years and Copthorne Inns, one of the biggest inn bunches on the planet. Tragically, shares of City Advancements have created complete negative returns of 5.5% in the course of recent years.

A land speculation trust (REIT), CapitaLand Shopping center Trust (SGX: C38U), checks in at fifth spot. The REIT houses the absolute most prevalent shopping centers around Singapore and has a business sector top of S$7.7 billion. CapitaLand Shopping center Trust likewise outflanked its supporter, CapitaLand, by creating a 54.2% aggregate return throughout the most recent five years.

The SGX Land List has a weighted normal cost to-book proportion of 0.9 and it has delivered a normal return of more than 82% in the most recent five years. This implies every one of the five stocks above have slacked the normal aggregate return of the land record.

By chance, every one of the five land stocks are additionally segments of Singapore's business sector indicator, the Straits Times List (SGX: ^STI).

Visit www.mmfsolutions.sg and register yourself for trading. Get 3 days free trials and make profits in stock market.

Two or three months back, I shared that there are 12 Singapore-recorded stocks which are in the FTSE Esteem Stocks ASEAN File.

As a fast refresher, the target of the record is to distinguish quality and neglected worth stocks recorded in ASEAN stock trades. The file picks its stocks utilizing a restrictive worth screening process which incorporates valuation, quality, and contrarian variables.

In the valuation gathering are things, for example, a stock's cost to-income (PE) proportion and profit yield. The quality elements incorporate a stock's arrival on value, working overall revenue, and net adapting.

A late report uncovered that an as of late recorded stock in Singapore is additionally part of the FTSE Esteem Stocks ASEAN List. The stock is Top Glove (SGX: BVA)(KLSE: 7113.KL). Here are five speedy realities about the organization that speculators may discover valuable:

The glove producer looked for an auxiliary posting in Singapore in late June this year. Top Glove has been recorded in Malaysia since 2001. The organization was at that point part of the FTSE Esteem Stock ASEAN File before its appearance in Singapore's securities exchange.

Top Glove was established in 1991 by Dr Lim Small Chai. At present, Dr Lim serves as the association's official executive.

In a prior meeting, Dr Lim said that when he was thinking about what business to begin, he understood that restorative gloves gave great edges and that the social insurance segment demonstrated solid development. Eventually, he chose to pursue the glove producing industry.

The move has paid off. Top Glove is the world's biggest elastic glove producer by volume. The organization as of now works 27 offices around the globe, with a yearly generation limit of 45 billion gloves. As indicated by Dr Lim, the firm has a 25% piece of the overall industry of the regular elastic gloves market.

Dr Lim trusts that worldwide glove interest can develop at a rate of 6% to 8% every year over the long haul. He has set Top Glove an objective of accomplishing a 30% piece of the overall industry by 2020.

Gold costs plunged in Asia on Monday as financial specialists took comments toward the end of a week ago by Encouraged seat Janet Yellen as to a great extent reliable with an information driven choice on the planning of any loan fee climb.

Gold for December conveyance on the Comex division of the New York Trade fell 0.18% to $1,323.55 a troy ounce.

Additionally on the Comex, silver fates for September conveyance plunged 0.54% to $18.550 a troy ounce. Copper prospects for September conveyance efell 0.26% to $2.079 a pound.

This week, nonfarm payrolls information from the U.S. in the spotlight alongside information on China's assembling part, in the midst of progressing worries over the soundness of the world's second greatest economy. Markets in the U.K. are shut on Monday.

A week ago, gold costs flipped amongst increases and misfortunes on Friday, before closure minimal changed as business sectors surveyed the probability of a loan fee climb at the following Central bank meeting September, taking after remarks from the main two authorities at the national bank.

Regardless of Friday's unobtrusive additions, the yellow metal finished with a week by week loss of $20.30, or 1.5%, the greatest decay subsequent to mid-July.

Amid a greatly anticipated discourse at the Federal Reserve's Jackson Gap symposium Friday, Yellen said the case for U.S. loan cost treks has "reinforced" as of late because of enhancements in the work advertise and to desires for strong financial development.

In any case, she didn't demonstrate when the Fed would act, saying that higher loan fees will rely on upon approaching financial information.

Talking in the blink of an eye a short time later, Bolstered Bad habit Seat Stanley Fischer said Yellen's discourse was "predictable" with desires for perhaps two more rate climbs this year, opening the way to a September trek. Fischer, the Federal Reserve's No. 2 policymaker, said the Work Office's occupations report for August will probably weigh on the choice over a trek.

As indicated by Investing.com's Encouraged Rate Screen Device, financial specialists are evaluating in a 33% shot of a rate climb by September.

The valuable metal is delicate to moves in U.S. rates, which lift the open door expense of holding non-yielding resources, for example, bullion, while boosting the dollar in which it is evaluated.

Sembcorp Marine Ltd (SGX: S51) is in somewhat of a funk right now.

The oil rig manufacturer endured a $290 million misfortune in 2015. In the second-quarter of 2016, its income shrank by a quarter while benefits dove by just about 90%.

Wong Weng Sun, CEO of Sembcorp Marine, secured a heap of the organization's issues amid the late 2016 second-quarter income preparation.

Here're five quotes from Wong you might not have any desire to miss.

On a delayed downturn :

Wong noticed that oil costs have recouped from its lows. Be that as it may, the recuperation is not anticipated that would convey requests to Sembcorp Marine's doorstep. He clarified:

"Regardless of oil costs recouping from late lows of beneath US$30/barrel to the present US$45 – US$50/barrel range, industry specialists keep on forecasting a delayed downturn for the upstream oil and gas industry. Naturally, with less penetrating contracts and excess of apparatuses, some drillers keep on being not able take conveyance of their new form rigs."

On postponements in conveyance :

Sadly, there have additionally been deferrals in the conveyance of jackup apparatuses. Wong shared insights about the postponements for four apparatuses in the quote underneath:

"Conveyance of a few apparatuses in our request book has been conceded, including 3 jackups for Oro Negro and 1 lift for Perisai. We are at present in dialogs with these clients to create answers for the apparatuses. Every finished apparatus have been in fact acknowledged by their particular clients."

On top of this, there is the lawful case with Marco Polo Marine Ltd (SGX: 5LY) for Sembcorp Marine to manage. Wong said that mediation procedures are progressing. You can discover more about the Marco Polo Marine case here.

On income and the asset report :

Along these lines, there have been deferrals in client conveyances. This asks the inquiries: How is Sembcorp Marine getting paid? How solid is its accounting report? Wong shared this announcement too:

"The Gathering stays focused on effectively deal with its monetary record to keep up a sound money related position. We stay concentrated on the convenient and compelling execution of our request book to guarantee effective conveyances of our tasks in order to enhance our money streams and liquidity position.

The larger part of our current S$9.2 billion request book is with advancement installment terms. Under 20% of our request book is for boring apparatuses which are on back-finished installment terms. In that capacity, the requirement for crisp working cash-flow to satisfy such requests in the following years will keep on decreasing."

To put it plainly, the greater part of Sembcorp Marine's present request book will see client installments come in before simultaneously. Wong is cheerful that there will be less requirement for crisp working capital, accordingly.

Discussing working income, Wong likewise had some uplifting news to share. He trusts that Sembcorp Marine's money streams will empower it to diminish its net adapting to short of what one sooner rather than later:

"In 1H2016, we produced S$175 million of Working Income (before working capital changes). Taking after further receipts from late conveyances, including the Honorable Lloyd Respectable apparatus and settled stage ventures, we produced a further positive working income of S$909 million in the month of July 2016. This will decrease our net adapting from 1.07x in 1Q2016 to under 1.0x in a matter of seconds.

As shared amid our FY15 results instructions, we trust our working capital needs have crested, and adapting ought to enhance over the span of 2016."

Be that as it may, on the off chance that we hover back to his first quote, the difficulties still stay for Sembcorp Marine. The apparatus developer has cut its interval profit in 2016 by more than 60%. Wong finished his discourse with an announcement on where Sembcorp Marine's need will be:

"While it is misty how extended this downturn will be, we have found a way to position ourselves for the difficulties ahead. We will keep on adopting a taught approach in dealing with our expenses and funds to keep up a solid asset report to guarantee satisfactory money and enhanced adapting. Our key need remains the opportune and successful execution of our request book.

We will keep on proactively look for crisp chances to develop our business and request book to convey maintainable returns for the Gathering and our shareholders."

Hyflux Ltd (SGX: 600), one of only a handful few organizations in Singapore's securities exchange that arrangements with water-related innovations and offices, discharged its most recent profit comes about only two weeks prior.

The outcomes were for the main portion of 2016. Amid that period, the organization's benefit fell definitely by 69% to S$9.9 million notwithstanding seeing its income more than triple from S$155 million a year prior to S$508 million.

Because of the way of its plan of action, with a substantial rate of income originating from designing, acquisition, and development (EPC) employments, Hyflux's incomes and benefits have been unpredictable. For speculators, this displays a test as it is hard to conjecture the benefit of the organization.

Yet, all these might change later on as Hyflux enters the purchaser staples industry by offering packaged drinking water. Generation of the organization's ELO-marked packaged drinking water is required to begin in Singapore in the second from last quarter this year.

Back in November 2015, Hyflux had purchased a minority stake in Kaqun Europe, a customer water innovation organization. The arrangement additionally included Hyflux and Kaqun Europe cooperating in a 70-30 joint dare to fabricate, offer, showcase, and disperse the ELO brand of savoring water the Asia-Pacific, Center East, and Africa areas.

ELO is showcased as a premium filtered water brand with medical advantages. As per its site, ELO is an "exceptional oxygen-rich water that feeds the body from inside… " This packaged beverage does not come shoddy however – ELO's site recorded a cost of S$63.80 for only six 240ml containers.

From its image situating, ELO won't not be a mass business sector item but rather, a specialty wellbeing item. Hyflux CEO Olivia Lum has remarked that she is hopeful about the capability of the ELO business.

This denote another course for Hyflux and can possibly push the organization toward a more buyer driven plan of action as opposed to its present venture based B2B model. Be that as it may, given the specialty position of the item and Hyflux's absence of marking and conveyance experience, it is still too soon to know how fruitful this new pursuit may be for the organization.

Visit www.mmfsolutions.sg and register for 3 days free trials and make profits in stock market.

The leading group of the Baltic Trade has consistently suggested that shareholders vote in support the proposed procurement by Singapore Trade (SGX: S68). The £87 million arrangement, which is liable to administrative endorsement, is relied upon to be finished before the end of November.

Dealers now imagine that there is 53.5% possibility of a rate climb by the US Encouraged for the current year. The adjustment in slant took after remarks from Central bank bad habit executive Stanley Fischer, and Bolstered authorities William Dudley and John Williams. Be that as it may, everything depends on Janet Yellen's location at the Jackson Opening symposium.

Buyer costs have succumbed to 21 straight months in Singapore. However, market analysts are hesitant to portray it as a deflationary winding. They guarantee that center swelling, which bars unstable segments, for example, expense of settlement and auto costs, is still positive.

There is uplifting news for mortgage holders as Sibor rates tumbled to a three-month low. The engaging quality of the Singapore dollar has provoked the powers to cut the key three-month Singapore interbank offered rate to 0.87192%.

Apple has hurried out a product fix that expects to bulk up security for its iPhones. It was accounted for that 3 imperfections have been found in Apple's iOS programming. Evidently, programmers can read instant messages and messages, and track calls and contacts. The hacking programming can even record sounds, gather passwords and follow the whereabouts of the telephone client.

One of the greatest failures in Singapore's offer market this week is Broadway Mechanical Gathering Ltd (SGX: B69). It has lost 11.5% since last Friday to close at S$0.23 yesterday. In correlation, the Straits Times Record (SGX: ^STI) has plunged by just 1% to 3,314 focuses in the same time frame.

Broadway Mechanical was established in 1969 and got recorded in our shores in 1994. It is one of the main three producers of actuator arms and related gathered parts for the worldwide hard circle drive industry. Having a reputation of more than 40 years, it additionally gives eco-accommodating froth answers for bundling, protection, car, restorative and different applications.

On 1 August 2014, the firm declared its second quarter income. Income for the three months finished 30 June 2014 went up 7.3% year-on-year to S$170.3 million because of a decent appearing from both its Froth Plastics division and Parts division. The previous timed deals development of 16.3%to S$48 million, while the last's top-line expanded by 4.2% to S$122.3 million. Net benefit became excessively by 90.5% to S$301,000.

Starting 30 June 2014, Broadway Modern just had a money parity of S$15.7 million however had complete borrowings of S$160 million. The outfitting proportion, which is the proportion of aggregate borrowings to shareholders' assets, remained at 0.75.

Broadway Mechanical finished its profit declaration by saying that it "stays mindful on its prospects" for 2014. Statistical surveying investigates the hard plate drive industry have guage that the business will stay level or just have a slight upside for whatever is left of the year.

Around the same time, the organization additionally made open that it will do a rights issue. Two rights shares will be accessible for membership by shareholders for each fifteen customary shares held. The issue cost for every right share will be S$0.18 and up to 55.5 million rights shares will be issued.

Net continues, in the wake of deducting costs and expecting every one of the rights shares are taken up, is assessed to be at S$9.64 million. The returns will go towards reimbursement of obligation, help the organization in its rebuilding arranges, and give dry powder to development open doors.

Broadway Modern will likewise see its equipping proportion venture down from 0.75 to 0.71 after the rights issue, accepting obviously, that every one of the rights shares are subscribed for. Broadway is exchanging at 58 times its authentic profit as of Thursday's nearby and has not paid profits subsequent to 2013.

In a 1999 meeting, measurable bookkeeper Howard Schilit gave speculators a helpful trap for recognizing potential threat in a stock. He said:

"Net salary and income from operations ought to track pretty nearly. In the event that income from operations lingers behind net pay, normally the outcomes will be terrible."

One such organization with this attribute is Swiber Possessions Restricted (SGX: BGK), the scandalous bolster administrations supplier to the oil and gas industry that as of late broken down. The organization had created a benefit in every year from 2006 to 2014, however neglected to deliver positive working income with any kind of consistency. You can see it beneath:

Swiber's net pay and working income

Source: S&P Worldwide Business sector Knowledge

Having a powerlessness to produce income notwithstanding timing benefits might not have been the immediate trigger or even a major purpose behind Swiber's fall, however it could at present have been a valuable yellow banner to ready financial specialists that potential issues may lie ahead.

Regardless, I thought it is intriguing to screen through Singapore's securities exchange to see which organizations meet both criteria:

Created a benefit in each of its last three financial years

Had negative working trade stream out each of its last three financial years

Turns out, there were a significant number of organizations that appeared on my screen. I positioned every one of them by business sector capitalisations and here are the six biggest organizations (most noteworthy business sector top starts things out): Oxley Property Ltd (SGX: 5UX), CEFC Global Ltd (SGX: Y35), Aspial Partnership (SGX: A30), Hyflux Ltd (SGX: 600), Ying Li Universal Land Ltd (SGX: 5DM), and Lively Gathering Ltd (SGX: BIP).

Presently, an organization with a couple of years of negative working income in spite of being beneficial is in no way, shape or form bound to be in genuine peril ahead. Be that as it may, in the event that you see such a characteristic show up in the organizations you're put resources into, you might need to invest some energy diving into ensure everything is okay. Keep in mind Schilit's words.

Visit www.mmfsolutions.sg and register yourself to get 3 days free trials and other updates related to Singapore stock market.

As per a late report from bourse administrator Singapore Trade Restricted (SGX: S68), there are nearly 102 organizations in Singapore's securities exchange with a business sector capitalization above S$1 billion.

These sizable organizations originate from a scope of enterprises and every one of them offer a profit. I facilitate contracted down the rundown of 102 to the main 20 by business sector capitalization and from that point, I chose the five with the most noteworthy profit yields.

The SPDR STI ETF (SGX: ES3), a trade exchanged asset that mirrors the essentials of the Straits Times Record (SGX: ^STI), could make for helpful connection on the yields of those five billion-dollar organizations. Starting 23 August 2016, the SPDR STI ETF was putting forth a profit yield of 3.2%.

Here're what I got some answers concerning the five organizations from Singapore Trade's report and somewhere else (figures starting 15 August 2016, unless generally expressed):

Keppel Partnership Constrained (SGX: BN4) has the most noteworthy profit yield at 5.6%. Be that as it may, the marine designing and property improvement combination has delivered negative aggregate returns in the course of the last one, three, and five years. Keppel Partnership had additionally cut its break profit in 2016 by 33% and cautioned of a long and cruel winter ahead.

The following organization on the rundown is Oversea-Chinese Managing an account Corp Restricted (SGX: O39), or OCBC for short. OCBC is one of Singapore's enormous saving money trio and has a profit yield of 4.3%. In its most recent quarter, the second-quarter of 2016, the bank kept its profit unaltered from the prior year.

Singapore's biggest recorded organization, Singapore Broadcast communications Constrained (SGX: Z74), is additionally among the most astounding profit payers. It offers a profit yield of 4.1%. For its budgetary year finished 31 Walk 2016 (FY2016), Singtel's profit surpassed its free income. Financial specialists might need to watch on the off chance that this circumstance endures later on.

Singapore Carriers Ltd (SGX: C6L) flies in with a profit yield of 4.1% too. For its money related year finished 31 Walk 2016, Singapore Aircrafts expanded its profit by more than 100%. Financial specialists might need to look somewhat further back, however. The aircraft administrator has had an inconsistent long haul track record with regards to keeping up the level of its profit.

Another saving money mammoth, DBS Bunch Possessions Ltd (SGX: D05), rounds out our group of five with a 4.0% profit yield. As of late, DBS was gotten off guard one of its clients, the oil and gas bolster administrations supplier Swiber Possessions Constrained (SGX: BGK), chose to petition for liquidation. The last has subsequent to moved in an opposite direction from the liquidation choice and petitioned for legal administration.

Surprisingly the five most elevated yielding billion-dollar organizations all have yields that surpass the more extensive market's. High trailing profit yields can search heavenly for financial specialists, however it enlightens us nothing concerning what's to come. It's additionally significant that an organization's size alone does not go about as a security against profit cuts – Keppel Corp is a decent case.

As financial specialists, we might need to put our reasoning caps on to make sense of whether an organization – paying little mind to its size and trailing yield – can support or develop its profit.

Visit www.mmfsolutions.sg and register yourself for 3 days free trials and make profits in Singapore stock exchanges.

CapitaLand Business Trust (SGX: C61U) is one of the 30 segments of Singapore's securities exchange benchmark, the Straits Times File (SGX: ^STI). It has a business sector capitalisation of S$4.55 billion and is one of the biggest land speculation confides in the business sector.

The Workplace land segment is the principle segment of the REIT's wage; it represented 68% of CapitaLand's gross rental pay in the main portion of 2016. The Retail segment makes up 19% and the Inns and Tradition Center area takes up the staying 13%.

Solid portfolio

CapitaLand Business Trust's most recent profit (for the second-quarter of 2016) had two measurements which can give financial specialists some knowledge into the nature of its portfolio.

To begin with, the REIT posted a 97.2% portfolio inhabitance rate as at 30 June 2016, which is 2.1 rate focuses higher than the inhabitance rate of 95.1% in Singapore's center focal business area. Second, it has figured out how to build its normal month to month office rent for no less than 15 straight quarters in succession, from S$7.53 per square feet in the second from last quarter of 2012 to S$8.98 per square feet.

Five-stage esteem creation cycle

One conceivable supporter to CapitaLand Business Trust's capacity to do both is its five-stage esteem creation cycle demonstrated as follows:

Capitaland business trust cycle

Source: CapitaLand Business Trust's income presentation

The initial step of the cycle is to continue developing its portfolio. Right now, it has 10 office structures in its portfolio and the most recent expansion is CapitaGreen, a premium office tower that was finished in 2014.

CapitaLand Business Trust has a 40% enthusiasm for CapitaGreen and is gaining the staying 60% stake; the procurement is relied upon to be finished in the second from last quarter this year.

Next, the REIT will grow its properties' rents and inhabitance levels. CapitaLand Business Trust keeps a differentiated rundown of inhabitants regarding the monetary areas they are in.

The REIT's occupants have a place with 11 segments on the whole. Managing an account, Protection and Monetary Administrations occupants represented the lion's offer of the REIT's rent at 31% in the second-quarter of 2016. Likewise, the main 10 occupants represented 40% of CapitaLand Business Trust's gross month to month rental wage.

In step three of the cycle, the REIT improves its benefits intermittently.

This is trailed by step four and five, in which CapitaLand Business Trust will offer its properties at the right esteem and reuse the assets, individually. . The REIT had sold three resources in 2010 and 2011 and the assets were reused for the improvement of CapitaGreen.

Final Conclusion:

It stays to be checked whether CapitaLand Business Trust can keep its quality creation cycle murmuring along later on. There is an excess of new supply of office space in Singapore coming online this year and this is relied upon to prompt a fleeting increment in the business sector opportunity rate.

Visit www.mmfsolutions.sg and register yourself for trading. Get 3 days free calls and make profits in stock market.

The Olympics 2016 have begun for some time. In the soul of the diversions, I might want to show a gold decoration for specific classifications to organizations recorded here in Singapore. I might want to show a gold award for:

The organization with the most noteworthy income

The organization with the most noteworthy benefit

The organization with the most noteworthy business sector capitalization

Gold in income

Unexpectedly, the organization with the most astounding income in our neighborhood market has not had such an incredible year. Respectable Gathering Ltd (SGX: N21) finish the rundown with its income of over US$61 billion in the course of the most recent 12 months. Unfortunately, that colossal income base has not meant benefit. Over the same time frame, the organization timed lost more than US$1.7 billion.

Respectable Gathering's offer cost has likewise taken a genuine beating in the course of recent years, losing near 90% of its worth. Today, Respectable Gathering is exchanging at S$0.15 per offer.

Gold in benefit

The organization with the fattest benefit in Singapore is none other than Southeast Asia's biggest loan specialist DBS Bunch Property Ltd (SGX: D05). The bank created S$4.3 billion in benefit in the course of the most recent 12 months. DBS controls S$451 billion in resources and has a solid nearness in Southeast Asia and More prominent China.

Gold in Business sector Capitalisation

At last, the gold decoration for the business sector capitalisation class will go to, of course, Singapore Media communications Constrained (SGX: Z74). Singapore's biggest media communications organization has a business sector capitalisation of S$64.9 billion and has been the biggest organization in the share trading system here for quite a while.

Singtel likewise works a telco in Australia and has interests in numerous different telcos around the globe. By and large, the organization has a nearness in 25 nations and achieves more than 605 million portable clients.

Stupid Rundown

The three organizations specified top their classifications in a rundown of more than 700 Singapore-recorded organizations. However, as we have seen, getting a gold award here does not as a matter of course imply that an organization will be an awesome speculation. Financial specialists ought to dependably lead research on organizations past shallow names, for example, 'most astounding income,' 'most elevated benefit' and so forth.

Visit www.mmfsolutions.sg and get updates related to the same. Subscribe and get 3 days free trials.

I was watching the nightly news on Singapore's Mandarin Television slot yesterday when an expert was conveyed on to share some of his bits of knowledge about the present circumstance with oil and gas administrations supplier Swiber Possessions Restricted (SGX: BGK)

For those of you uninformed, Swiber's administration group had as of late chosen to close down for business and spot the organization under legal administration. One of the enormous explanations behind Swiber's inconveniences is its substantial obligation load – in view of its most recent financials (starting 31 Walk 2016), it has a net-obligation to value proportion of 194%.

The expert on television specified that the low financing cost environment the world ended up in the course of the most recent couple of years had incited Swiber to increase its borrowings. The information underpins this perspective.

Swiber's net-obligation to value proportion five years prior was a much lower (yet at the same time high) 112%. In the mean time, the US's national bank, the Central bank, has kept benchmark loan fees there low – truth be told, almost zero – as far back as the monetary emergency emitted in 2008 (financing costs in Singapore are unequivocally connected to what happens in the US).

I presently have no shrewd perspectives over what loan fees may do as it's not something I figure an excess of my venture basic leadership. In any case, the investigator's remark made them think: What are a portion of the organizations in Singapore's securities exchange that might be most at danger of running into challenges if loan fees begin rising?

You may review that the Central bank raised the US's benchmark loan costs without precedent for December a year ago after almost 10 years of not doing as such.

To discover the answer, I ran a screen on Singapore-recorded organizations with a business sector capitalisation of in any event S$1 billion to locate the ones with the least working pay to-interest-cost proportions. My discerning for the model is that organizations with a low proportion are the ones with minimal space for blunder set up to handle any conceivable financing cost climbs.

Right away, here are the five expansive top organizations with the most minimal working wage to-premium cost proportion in Singapore's business sector: Sembcorp Marine Ltd (SGX: S51), Honorable Gathering Constrained (SGX: N21), Yoma Vital Possessions Ltd (SGX: Z59), Perpetual Land Property Restricted (SGX: 40S), and OUE Ltd (SGX: LJ3).

Sembcorp Marine, Honorable, Yoma Key, Enduring, OUE, interest scope proportion table

Source: S&P Worldwide Business sector Insight

It merits specifying that the quintet would not as a matter of course keep running into predicament later on.

I've not looked through their organizations in an excessive amount of subtle element. In this way, it's conceivable that some – or even every one of them – had acquired some huge one-time working costs in the course of the most recent 12 months that had influenced their working pay just incidentally. Then again maybe, it's ordinary for them to clock low or negative working wage due to the way their plan of action capacities.

See their low working pay to-interest-cost proportions as a yellow-banner and a require a more profound study to see whether something's without a doubt wrong, not as a sign that they are on death column.

Visit www.mmfsolutions.sg and register yourself for trading. and get 3 days free trial to make your trading beneficial and profitable.

For financial specialists who take after the nearby securities exchange, you'll know organizations here are amidst Income Season, caught up with reporting their most recent quarterly results. Specifically, a few organizations have made declarations of profit expands that may be music to the ears of pay speculators.

How about we investigate some of these shares that have knock up their profit payouts in the course of the most recent two weeks.

Indiabulls Properties Speculation Trust (SGX: F3EU)

Indiabulls Properties Investement Trust (IPIT) is a business trust that claims an aggregate of five premium office structures and private properties in India as of Walk 2012. It is overseen by the Indiabulls Bunch – an Indian aggregate that produces power, gives financing and grows land in India – under its Indiabulls Land Constrained arm.

The business trust proclaimed a dispersion of 0.0297 pennies for its as of late finished money related year, a change from a year ago's zero-payout. The trust has a spotty history in making benefits, and it could pronounce disseminations to unit holders in just two out of its last five finished budgetary years.

Despite the fact that the trust appears to have turned its operations around to warrant some conveyance installments, it's great to note that its dissemination yield of 0.3% (at the present unit cost of $0.11) is a long ways from the business sector's yield, spoke to by the Straits Times List's (SGX: ^STI) profit yield of 2.9% toward the end of April 2013.

Singtel (SGX: Z74)

Singapore's biggest organization by business sector esteem has supported its profits once more to $0.168 per offer, a 6.3% expansion from a year ago's payout of $0.158. The broadcast communications goliath has a budgetary year that begins and closures on Spring and it has either kept up or expanded its profits (barring uncommon profits) beginning from in any event Walk 2005.

SingTel had persevered through a troublesome year with its most recent entire year results, discharged on 15 May, demonstrating a 12% drop in profit for the year to S$3.51b. In any case, that did not prevent the organization's administration from keeping on compensating shareholders with a fatter profit check.

At an offer cost of $4.02, shares of SingTel are offering for 18 times profit with a profit yield of 4.2%.

Singapore Carriers (SGX: C6L)

Singapore's banner boat carrier posted a 13% expansion in yearly income to $378.9m from $335.9m a year back for its most recent entire year results. Alongside the benefit expand, shareholders were likewise welcomed with a profit of $0.23 per offer, up 15% from a year ago's $0.20 per offer payout.

SIA has one of the best cost-controls in the business, notwithstanding being up to 40% less expensive to keep running than spending bearers. Be that as it may, in an impression of the carrier business, the previous two years weren't caring to SIA in light of a sharp fall in benefit from the $1.092b it earned in the budgetary year finishing Walk 2011.

The carrier's at present exchanging at a grandiose Value Profit proportion of 34 and games a profit yield of 2.1% at its present offer cost of $10.93.

SIA Designing (SGX: S63)

The designing related organization rounds up our rundown today and we've spared the best for last – SIA Building has the most elevated profit yield among the four organizations today at 4.4%. Its late entire year results saw it declare a profit of $0.22 per offer, 5% higher than a year ago's payout of $0.21.

Given its name, it won't not be that amazing to discover that SIA Building is really an auxiliary of SIA. With its normal everyday employment of looking after, repairing, and updating airplanes for more than 80 aircrafts around the globe, the organization has relentlessly developed its benefits throughout the years. It's presently gaining $270.1m, twofold its benefit of $139.9m ten years back for the monetary year finishing on Walk 2004.

Along the way, shareholders have additionally been remunerated with greater profits. On the off chance that we prohibit unique profits, SIA Building has been knocking its profits higher consistently beginning from Walk 2010.

SIA Designing has a present offer cost of $5.04, speaking to a PE of 21.

Visit www.mmfsolutions.sg and register yourself for trading. and get 3 days free trial to make your trading beneficial and profitable.

Singapore Broadcast communications Constrained (SGX: Z74) is the biggest recorded organization in Singapore. It is additionally the biggest player among the trio of media communications administrations suppliers in Singapore (the other two are M1 Ltd (SGX:B2F) and StarHub Ltd (SGX:CC3)).

Given Singtel's weight, there may be things financial specialists can gain from its administration group. As of late, Singtel's boss corporate officer, Jeann Low, gave a meeting. I had chosen two key experiences that might be valuable for financial specialists:

1. The significance of cooperation

"It's not about my individual commitments to the Gathering. In Singtel, we work as a group. We generally discuss building a star group, as opposed to a group of individual stars"

Low focused on the significance of cooperation at Singtel.

This could be critical as Singtel has organizations that stretch out a long ways past Singapore's shores; it has stakes in broadcast communications firms in Thailand, India, Indonesia, Philippines, and Australia. Singtel's offerings likewise incorporate cybersecurity administrations, portable video spilling administrations, and the sky is the limit from there.

2. Concentrating on clients

"Client centricity is vital. By the day's end, the client pays our bills."

Another key thing Singtel holds in high respect is client centricity.

Singtel serves both buyers and undertaking clients. Low highlighted the significance of clients by taking note of that the last pays the bills for the organization. In the event that Singtel can keep hold of its portable supporters, for case, this gives an important income stream and income for the telco to reinvest in the business or pay out profits.

Visit www.mmfsolutions.sg and register yourself and get 3 days free trials that will help you to make profits in your financial business. Calls provided are all well researched.

Property is not an unthinkable venture similarly as Warren Buffett is concerned. He just needs to have the capacity to gauge the yield on a venture over the lifetime of the speculation. With Yanlord Land Bunch (SGX: Z25) he may very well have that.

The organization is a Singapore-recorded Chinese property designer. It assembles top of the line private and business property, which it consequently holds for long haul for their repeating incomes.

Buffett likes organizations with low profit instability. Since 2004, the Yanlord has produced around S$299 million in income consistently. A year ago, the property engineer reported a main concern benefit of S$321 million.

By and large Yanlord's Net Salary Edge is around 17%, which is entirely high. It has been as high as 26% in 2010, however a year ago it dropped to around 9%.

Buffett likewise needs his organizations to sweat their benefits. Despite the fact that Yanlord is resource substantial, it makes great utilization of what it has.

In the course of the most recent decade, it produced around S$23 of offers on each S$100 of benefit available to its. A year ago's Benefit Turnover was in accordance with its long haul normal of 0.23. Besides, has expanded relentlessly from S$361 million in 2004 to S$3.6 billion a year ago.

Yanlord makes utilization of influence. A year ago it reported Aggregate Resources of S$85.9 billion and Aggregate Liabilities of S$55.9 billion, which likens to an Influence Proportion of 2.8.

That could be a region of concern, given that about a fourth of the liabilities are contained both long and fleeting advances. Presentation to obligation could make the organization helpless against macroeconomic dangers, for example, undesirable loan fee developments.

As a last check, Buffett likes stocks that are shabby contrasted with their book values. As of now, partakes in Yanlord Land cost around S$1.28 a piece, while its book esteem per offer is S$2.14. A cost to-book of only 0.6 may engage Buffett's longing for worth.

Yanlord ticks a hefty portion of the cases that Buffett would search for in a decent venture. He may very well run his slide guideline over the organization a couple more times, just to ensure he is getting great worth for his cash.

I have a propensity for taking a gander at how modest or costly stocks in Singapore are toward the begin of every month and I do this for a justifiable reason: Knowing where we are can give us critical and valuable contributing point of view. Howard Denote, an amazingly savvy financial specialist, once said: "We may never know where we're going, however we would do well to have a smart thought where we are."

One perspective on quality :

In this activity, I utilize two diverse approaches to take a gander at the estimation of stocks in Singapore. The first is more straightforward and includes a correlation of the business sector's present valuation with the long haul normal.

In our nearby setting, the "business sector" can be spoken to by the Straits Times Record (SGX: ^STI). Information on the basics of the SPDR STI ETF (SGX: ES3) can likewise be a decent intermediary for those of the file. That is on the grounds that the SPDR STI ETF is a trade exchanged asset that emulates the Straits Times Record.

The accompanying are the valuation numbers I'm keen on:

Long haul normal: The Straits Times File has had a normal cost to-profit (PE) proportion of 16.9 for the 37 years from 1973 to 2010.

Current valuation: The SPDR STI ETF has a PE proportion of 12 starting 31 July 2016.

Occurrences when amazing valuations showed up: 1973 is a decent case of a year with high valuations as the Straits Times List's PE came to 35. The begin of 2009 is an instance of the business sector being truly shabby as the chronicled PE tumbled to only 6.

Given the numbers we've seen, I believe it's sensible to infer that stocks in Singapore are less expensive than normal right now. So, it's reasonable too that we're not near insane modest domain.

Another perspective on worth :

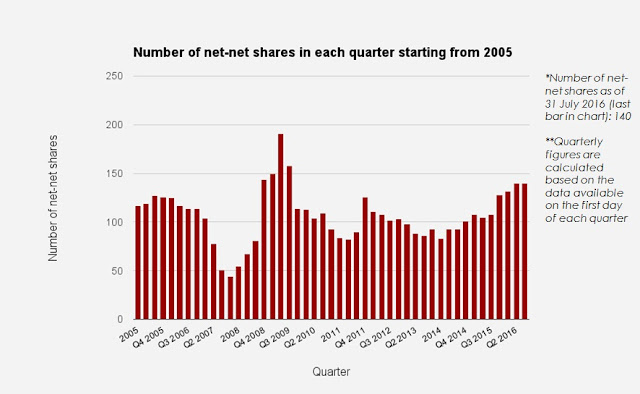

The following strategy I use to gage the estimation of stocks in Singapore is to check the quantity of net-net stocks there are in the business sector.

A net-net stock is a stock with a business sector capitalisation that is lower than its net current resource esteem. Numerically, the net current resource worth is given by this condition:

Net current resource esteem = Aggregate current resources less aggregate liabilities

In principle, a net-net stock is an extraordinary deal. That is on account of financial specialists can get a markdown on the organization's present (resources, for example, money and stock) net of all liabilities. Additionally, the organization's settled long haul (resources, for example, properties, industrial facilities, seemingly perpetual hardware and so on.) are tossed in with the general mish-mash for nothing.

In this way, the rationale takes after that if there are an extensive number of net-net stocks around in Singapore, then the business sector is prone to be truly modest.

Here's a graph demonstrating how the net-net stock check in Singapore has changed subsequent to the begin of 2005:

Number of net-net shares in every quarter beginning from 2005 (July 2016)

Source: S&P Worldwide Business sector Knowledge

There are two things I need to call attention to with the graph. To start with, the quantity of net-net stocks achieved a low of under 50 in the second-50% of 2007; that is additionally the time when the Straits Times Record topped amid the Incomparable Money related Emergency. Second, the quantity of net-net stocks almost hit 200 in the second-50% of 2009; that was the time when the Straits Times List achieved a base amid the emergency.

Starting 31 July 2016, there are 140 net-net stocks. This number of 140 sits between the two extremes found in the previous decade and is likewise close to the most elevated it has been following the second-50% of 2009. These lead me to imagine that stocks in Singapore are nearer to the modest end at little to no cost to-costly range.

A Numb-skull's take :

I've shared two unique techniques to esteem the share trading system in Singapore and both give comparative takeaways: Stocks in Singapore are modest, however not low priced.

As a long haul financial specialist, this sounds like what my ears were waiting to hear. Presently, I had stressed the expression "long haul" for a justifiable reason. Valuations let us know almost no about what stocks will do over the short-term. It's just over long time skylines that valuations begin getting to be vital.